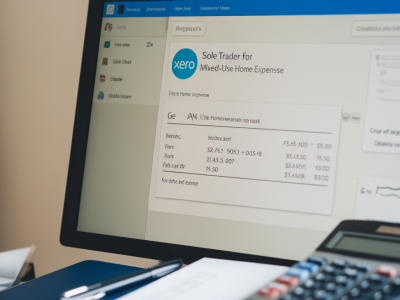

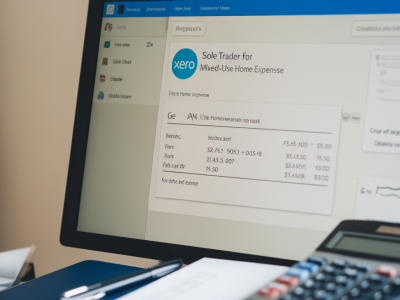

Working from home raises a recurring question for many sole traders: can I reclaim the VAT on my home expenses, and if so, how do I record it properly in Xero? I've helped lots of small business owners sort this out, and the short answer is: you can...

Read more... →

When you run an owner‑managed SME, one of the most common—and frustrating—questions is: how much should I pay myself as salary, and how much as dividends? I see this with almost every client: founders want to take a sensible income, minimise...

Read more... →

I work with a lot of businesses that rely on machinery, vehicles or specialist kit — cafés with espresso machines, small manufacturers with CNCs, builders with vans and diggers. One question I get asked more than any other is: how can I plan...

Read more... →

I’m often asked by small limited company owners which tax reliefs they should be claiming and, more importantly, how to make sure they aren’t leaving money on the table. Over the years I’ve helped dozens of micro and small companies identify...

Read more... →

I work with a lot of small, seasonal businesses — market stalls, tourist accommodation, pop‑up cafés, Christmas shops and online sellers whose turnover spikes for a few months and trickles for the rest of the year. VAT is one of the most common...

Read more... →

VAT inspections are stressful for many small business owners — I’ve been there with clients who suddenly get a letter from HMRC asking for records. The good news is that most inspections are straightforward if your bookkeeping is tidy and you...

Read more... →

Getting a letter from HMRC saying they’re opening an enquiry is one of those moments every small business owner dreads. I’ve supported many clients through this exact situation, and while it’s stressful, it’s usually manageable if you act...

Read more... →