Bookkeeping Tips

Feb 06, 2026

• by Éloïse Durand

I get asked a lot: “Can I hire someone just for year-end without handing over the keys to my business?” The short answer is yes — but only if you choose the right temporary bookkeeper package and set clear boundaries from the start. Over the years I’ve helped many micro and small businesses bring in short-term help for VAT returns, year-end accounts, or a clean-up before a tax filing. The...

Read more...

Latest News from Quinnaccountants Co

Onboarding a new supplier in hospitality can feel dull compared with menu design or front-of-house training, but get it wrong and you’ll see late costing, margin erosion and frustrated teams fast. Over the years I’ve seen kitchens lose margin because a line was coded incorrectly, pubs pay for...

Read more... →

Losing a major client is one of the sharpest shocks a small business can face. I’ve guided many owners through this exact moment, and the first 60 days are critical: act too slowly and you risk cashflow strain that affects payroll, supplier relationships and your ability to win new work. Act...

Read more... →

I’ve seen it happen more times than I’d like: a busy business owner or a payroll handler runs payroll, authorises payments, and then—because of a second user click, an unclear bank feed, or a duplicate Direct Debit—HMRC ends up receiving two PAYE payments for the same pay period. It’s an...

Read more... →

Switching accounting software can feel like moving house: awkward, time-consuming and a little terrifying when you think about what might get left behind. I’ve helped dozens of small businesses make the jump — from sole traders to micro-limited companies — and I’ve seen the same issues come...

Read more... →

Running payroll feels straightforward until an RTI submission bounces back with a cryptic error code. I’ve spent years helping small businesses wrestle with payroll software, HMRC quirks and those afternoons when PAYE and National Insurance totals refuse to reconcile. In this guide I walk you...

Read more... →

When you run an owner‑managed SME, one of the most common—and frustrating—questions is: how much should I pay myself as salary, and how much as dividends? I see this with almost every client: founders want to take a sensible income, minimise tax and National Insurance, keep the company...

Read more... →

Running a freelance consultancy is rewarding — and chaotic. Early on I learned the hard way that tidy bookkeeping isn't just about compliance; it’s what lets you see where your business is going, price services correctly and avoid last-minute panics at tax time. Below I share the practical,...

Read more... →

I often tell clients that management accounts are like a torch in a dark room — they don’t have to be perfect or beautiful, but they must show you where the furniture is so you don’t trip over it. A simple, well-structured management accounts pack gives you the essential information to make...

Read more... →

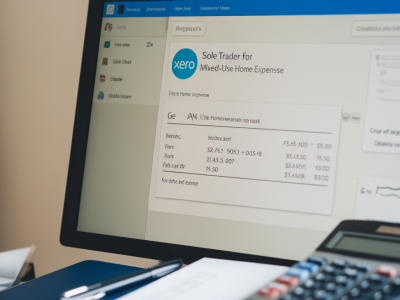

I rely on accounting software every day to keep tabs on cashflow, and one thing I see time and again is that the earlier you spot slow payers, the easier (and cheaper) it is to fix the problem. QuickBooks is a common choice, but the principles below apply to Xero, Sage and other cloud packages....

Read more... →

I remember the first time a new client asked me to recommend a bookkeeper. They were overwhelmed—but also relieved to hand over day-to-day bookkeeping. What many small business owners don’t realise is that finding someone who’s technically capable is only part of the job. The other...

Read more... →