Accounting Software Reviews

Feb 01, 2026

• by Éloïse Durand

I’ve been following niche e-commerce retailers for years, both as someone who advises small businesses and as a regular player on the court, so when I spotted an attractive padel racket sale at Bandeja Shop I immediately started thinking about the practical lessons for merchandising, customer experience and inventory planning that any small online retailer can learn from a specialist store. In...

Read more...

Latest News from Quinnaccountants Co

I’ve spent years helping retail shops, cafés and small restaurants tidy up their books, and one lesson keeps repeating: small bookkeeping errors quietly eat into profit until a sudden review reveals a worrying hole. In this post I’ll walk you through the most common, sneaky mistakes I see in...

Read more... →

Running a small business means living with a certain amount of uncertainty — seasonal demand, late-paying customers, sudden repairs, or an unexpected tax bill can all knock your cashflow off balance. I always recommend building an emergency cash reserve: a dedicated pot of money that keeps you...

Read more... →

Running a café means cash moves fast — cups of coffee, sandwiches, stock deliveries and wages all need to be tracked closely. I often recommend a simple, free spreadsheet as the first line of defence for weekly cashflow management. It’s flexible, quick to set up and gives immediate visibility...

Read more... →

Choosing between cash and accruals accounting is one of the first practical decisions every service business faces — and it’s one that affects how you see your cash position, how you manage tax, and how you talk about performance. I help lots of small service businesses make this choice, so...

Read more... →

I’m often asked by small limited company owners which tax reliefs they should be claiming and, more importantly, how to make sure they aren’t leaving money on the table. Over the years I’ve helped dozens of micro and small companies identify and apply for reliefs that are simple to claim yet...

Read more... →

Getting your payroll ready for its first PAYE submission can feel like standing at the edge of a cliff — one small slip and HMRC will certainly let you know. I’ve run payroll setups for dozens of small businesses, and the difference between a smooth first Full Payment Submission (FPS) and a...

Read more... →

I work with a lot of small, seasonal businesses — market stalls, tourist accommodation, pop‑up cafés, Christmas shops and online sellers whose turnover spikes for a few months and trickles for the rest of the year. VAT is one of the most common sources of cashflow shocks for them: a busy...

Read more... →

VAT inspections are stressful for many small business owners — I’ve been there with clients who suddenly get a letter from HMRC asking for records. The good news is that most inspections are straightforward if your bookkeeping is tidy and you know where your records live. Below I give a...

Read more... →

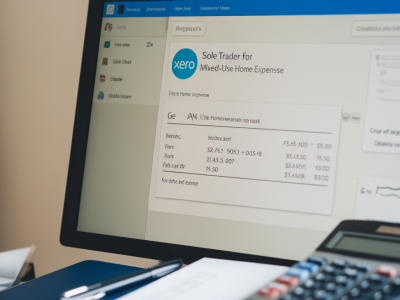

I run into this situation a lot when I advise one-person shop owners: you’re brilliant at your product and customer service, but bookkeeping feels like a jumble of receipts, tills and end-of-day cash. If your retail shop is a sole trader or single director limited company with under £50k...

Read more... →

Summer can be a double-edged sword for small businesses. While tourists swell footfall for some, others — particularly B2B service providers and seasonal retailers — see revenue thin out. Over the years I’ve helped clients survive (and sometimes thrive) through slow months by building...

Read more... →